Why Understanding Transformer Power Infrastructure Matters for Modern Living

The financial investment for an apartment transformer varies significantly based on multiple factors, but understanding these financial factors is essential for any multi-unit residential development. Here's what determines a transformer's financial value:

Key Financial Factors:

- Transformer capacity (kVA rating) - Ranges from 25 kVA for small buildings to 2,500+ kVA for high-rises

- Voltage requirements - Higher voltage ratings increase insulation and component financial requirements

- Installation type - Pad-mounted units typically represent a larger investment than pole-mounted alternatives

- Total investment of ownership - Includes the initial investment, installation, and 20-30 years of operational expenses

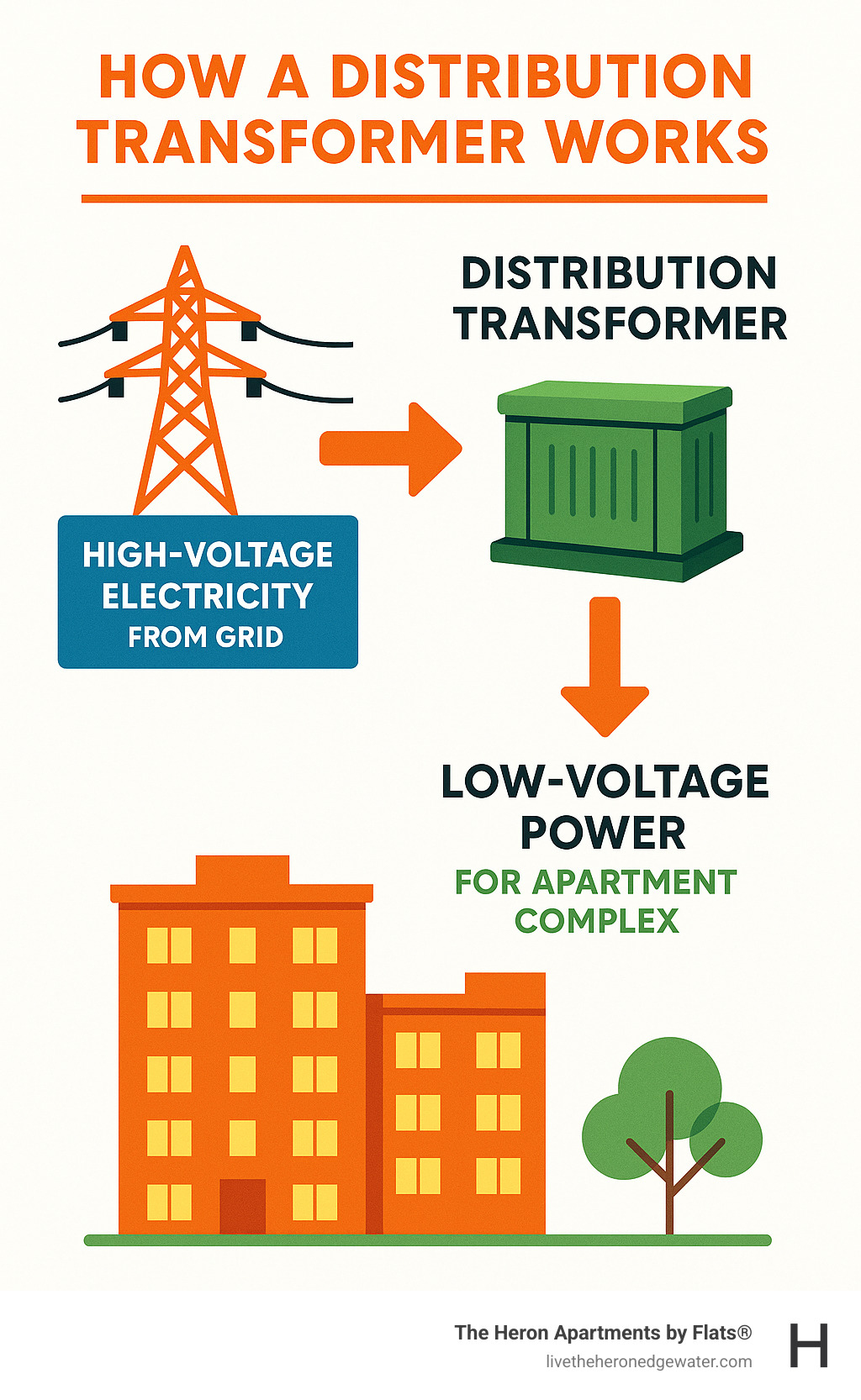

The small green electrical box you might notice outside apartment buildings plays a crucial role in modern urban living. These transformers step down high-voltage electricity from the power grid - often 7,200 to 35,000 volts - into the safe 240/120-volt power that flows through apartment walls to charge phones, run appliances, and power the amenities that define contemporary living.

For apartment buildings, transformer selection becomes particularly complex. Unlike single-family homes that might share a neighborhood transformer, multi-unit developments often require dedicated units to handle concentrated power demands from dozens or hundreds of residents simultaneously.

The process involves more than simply buying equipment. Site preparation, permits, installation labor, and long-term maintenance create a total financial picture that extends far beyond the initial purchase value.

Understanding the Core Factors of Transformer Financial Outlay

This section will detail the primary elements that determine the financial outlay for an apartment building transformer, helping property developers and managers make informed decisions.

How Transformer Size (kVA/MVA Rating) Influences Financial Investment

When we talk about transformer capacity, we're typically referring to its kVA (kilovolt-ampere) rating, or MVA (megavolt-ampere) for very large units. This rating tells us the maximum amount of apparent power the transformer can deliver. For an apartment building, sizing the transformer appropriately is paramount. It's not just about the number of units, but also the collective demand from residents' appliances, lighting, and all the common area needs like elevators, HVAC systems, and even our luxurious rooftop lounge.

The larger the kVA rating, the more power the transformer can supply, and generally, the higher its financial investment. However, this relationship isn't linear. For instance, doubling the capacity of a transformer doesn't necessarily double its initial investment. Instead, the investment might increase by a factor of 1.6 to 1.8 times, depending on other factors like voltage level and specific design features. This is because larger transformers require more raw materials, more complex manufacturing processes, and can even incur more significant installation procedures due to their increased size and weight.

The Role of Voltage Ratings in a Transformer's Financial Value

Transformers are all about changing voltage levels. They take the high primary voltage from the utility grid and step it down to a safer, usable secondary voltage (like the 240/120V that powers our homes in Edgewater, Chicago). The specific voltage ratings, both input and output, play a significant role in the overall apartment transformer's financial impact.

Higher primary voltage levels require more robust insulation, larger bushings with higher material requirements (the insulated conductors that allow power to pass into and out of the transformer), and greater physical clearances to ensure safety and prevent electrical arcing. For example, a transformer with a 1 MVA capacity could see its initial investment vary by more than tenfold simply based on its voltage rating and the required insulation class. These engineering requirements for higher voltages mean more specialized materials and manufacturing, adding to the financial outlay.

[More info about our Edgewater Chicago neighborhood].

Material, Type, and Design Choices

The physical characteristics and internal components of a transformer also heavily influence its financial value. We commonly encounter two main types for residential applications:

- Pad-mounted transformers: These are the familiar "green boxes" you often see discreetly placed on the ground, typically connected to underground electrical cables. They are favored in urban and suburban areas like Edgewater for their aesthetic appeal and improved safety.

- Pole-mounted transformers: These are mounted directly on utility poles and connect to overhead power lines. While they can be an option with a lower initial investment for the unit itself, they are less common in densely populated urban settings due to aesthetic and spatial considerations.

Beyond their mounting, transformers come in different internal designs:

- Dry-type transformers: These use air or solid insulation instead of oil. They are fire-resistant and ideal for indoor applications or areas where fire safety is a top concern. While generally a larger investment upfront, they can offer higher durability and reduced maintenance over their lifespan.

- Oil-immersed transformers: These are filled with mineral oil for cooling and insulation. They are robust, efficient at heat dissipation, and often used for heavy-duty outdoor utility installations.

The choice of winding material is another critical factor. Copper windings are superior conductors, offering better electrical conductivity and efficiency, but they represent a higher investment. Aluminum windings are an alternative with a lower initial investment. Additionally, the type of core material (e.g., silicon steel for better energy efficiency) and the cooling system (liquid-cooled systems, while representing a larger investment, offer better heat dissipation) all contribute to the final apartment transformer financial outlay.

Calculating the Total Apartment Transformer Financial Impact of Ownership (TCO)

While it's easy to focus on the initial purchase of a transformer, that's just one piece of the puzzle when it comes to the true financial impact of an apartment transformer. This section explores the full spectrum of financial considerations over the transformer's lifetime, painting a complete financial picture.

Beyond the Initial Equipment Investment: Installation and Site Preparation

When planning for an apartment transformer, it's natural to think about the equipment's initial investment first. But just like furnishing a beautiful apartment, there's a lot that goes into getting it ready for comfortable living! The installation process itself can actually represent a significant portion of the total financial outlay for an apartment transformer. We're talking about much more than simply plugging it in.

First, there's site preparation. This often means carefully excavating the ground and pouring a sturdy concrete pad to give the transformer a firm, level, and secure foundation. Then, consider the transformer's size and weight. These units are substantial! Moving and positioning them safely usually calls for specialized equipment like cranes and a highly skilled team of technicians and electricians. Plus, local authorities will require permits and inspections for electrical installations of this magnitude, ensuring everything meets safety codes. These fees, while necessary, do add to the overall investment. Finally, to ensure the well-being of everyone who calls The Heron home, proper grounding systems are essential, along with protective barriers or enclosures, especially for pad-mounted units that are easily accessible. Depending on the transformer's size and the unique layout of the site, these installation financial requirements can be quite substantial, highlighting just how important comprehensive planning is from the very beginning.

[More info about our luxury Amenities].

Factoring in Long-Term Operational Expenses

The true financial impact of an apartment transformer stretches far beyond its initial purchase and installation. We also have to think about the ongoing operational financial considerations throughout its many years of service, which can significantly impact the total financial impact of ownership (TCO).

One of the largest, often unseen, financial impacts comes from energy losses. Even the most efficient transformers lose a tiny bit of energy as heat, both when they're just sitting there (no-load losses) and especially when they're busy powering everyone's lives (load losses). These small energy losses add up over time, turning into ongoing utility charges. In fact, these energy losses can account for a significant portion—anywhere from 10% to 30%—of the transformer's total financial impact of ownership over its 20- to 30-year operational life. It’s a bit like choosing an energy-efficient appliance for your apartment; investing in more energy-efficient, low-loss transformers upfront, while they might represent a higher initial investment, can lead to substantial long-term reductions on electricity bills. It's a smart long-term play!

Just like a well-maintained vehicle, regular maintenance is another crucial ongoing financial consideration. To ensure optimal performance and extend its lifespan, transformers need routine care. This includes periodic inspections, taking oil samples (for those oil-immersed units), and specialized tests like Dissolved Gas Analysis (DGA) to catch any internal issues before they become big problems. Proper maintenance is key to preventing accelerated aging and significant failures down the line. These routine maintenance considerations can add another 5% to 15% to the transformer's TCO over its operational life. When we combine the initial capital investment with installation, ongoing energy losses, and necessary maintenance, the total financial impact of ownership can be a fair bit higher than just the original investment. Understanding this complete picture is truly vital for smart financial planning and strategic planning for a building's infrastructure.

Learn about U.S. DOE energy efficiency standards

How Safety and Regulations Affect the Apartment Transformer's Financial Impact

Safety is absolutely paramount, especially in a vibrant residential community like an apartment building. This unwavering commitment to safety directly influences the apartment transformer's financial impact due to strict regulatory requirements.

We must always adhere to the highest standards set by the National Electrical Code (NEC) and important local building codes, such as those right here in Edgewater, Chicago. These regulations dictate everything from the specific type of transformer that can be used indoors versus outdoors, to vital clearance requirements. For instance, pad-mounted transformers typically need to be placed a certain safe distance (often around 10 feet or more) away from residential buildings to ensure everyone’s well-being.

Beyond just placement, protective fencing, sturdy enclosures, and safety bollards are frequently required around outdoor transformers. These measures are critical for preventing unauthorized access and safeguarding against accidental damage. While these safety features are essential for the well-being of our residents and the broader community, they do add to the overall installation and site preparation financial requirements. Ensuring complete compliance with all environmental and safety regulations isn't just a good idea—it's a critical factor that directly influences the design and features of the transformer we choose for The Heron.

Estimating Transformer Needs for Different Buildings

From low-rise complexes to high-rise towers, the power requirements and subsequent transformer specifications can vary significantly.

Transformer Investment Ranges for Low-Rise vs. High-Rise Buildings

The size and scale of an apartment building directly influence its power demands and, consequently, the required transformer capacity. This means the financial investment for an apartment transformer will differ significantly between a sprawling low-rise complex and a towering high-rise.

The primary difference lies in the load calculation. This is simply figuring out how much electricity everyone in the building will need at any given time. High-rise buildings, with potentially hundreds of units, numerous elevators, extensive HVAC systems, and a wealth of shared amenities (like our state-of-the-art fitness center or luxurious rooftop lounge), have a far greater total power requirement. This concentrated demand necessitates a much larger kVA or MVA-rated transformer.

For a low-rise building with fewer units, the power demand is more modest, allowing for a smaller, less complex transformer. As we move to mid-rise and then high-rise structures, the kVA rating needs to increase substantially. This leads to a corresponding increase in relative investment due to the larger size, more complex engineering, and more robust components required. Think of it like comparing a small car engine to a powerful truck engine – they both do a similar job, but the truck's engine is built for much heavier work.

| Building Type | Typical kVA Range | Relative Investment |

|---|---|---|

| Low-Rise (e.g., 10-20 units) | Smaller kVA | Baseline |

| Mid-Rise (e.g., 20-50 units) | Medium kVA | Moderate Increase |

| High-Rise (e.g., 50+ units) | Larger kVA | Significant Increase |

Standard vs. Custom-Built Units for Specific Needs

When selecting a transformer, we often face a choice between standard, off-the-shelf models and custom-built units. This decision has a direct impact on the apartment transformer's financial requirements and lead time.

Standard models are manufactured in larger quantities to common specifications. They are generally have a lower initial investment and come with shorter lead times, making them a great choice when a building's needs align perfectly with what's readily available. They're like buying a pre-made suit – it fits most people well and is available right away.

However, for apartment buildings with unique architectural designs, specific spatial constraints, or advanced technological requirements, custom-built transformers might be necessary. These bespoke units are designed to meet very precise specifications, such as unusual voltage configurations, specialized enclosures to fit tight spaces, or advanced monitoring capabilities to integrate with smart building systems. For example, if a building has a very specific spot where the transformer absolutely must go, and no standard unit fits, a custom one can be built to size.

The trade-off for this custom solution is typically a higher financial investment—custom units can represent an investment anywhere from 20% to 100% higher than a standard model of similar capacity. This increased investment reflects the specialized engineering, low-volume production, and potentially non-standard components involved. Additionally, custom transformers often have longer lead times due to the unique design and manufacturing process. For us at The Heron, with our adaptable Ori Pocket Closet units, considering how power integrates into unique living spaces is always a priority.

Frequently Asked Questions about Apartment Transformer Financial Considerations

We understand that thinking about electrical infrastructure might bring up a few questions. It's perfectly normal! Here are some common inquiries we hear about the transformers that power apartment communities.

How long does a residential transformer typically last?

Good news! A well-cared-for residential transformer is truly built to last. Under normal conditions and with the right attention, you can expect a transformer to reliably provide power for 20 to 30 years. That's a long time!

With diligent maintenance and being in a good environment, some transformers can even keep working efficiently for as long as 50 years. Regular check-ups and preventative care are super important. They help keep the transformer running smoothly for as long as possible, ensuring our residents always have consistent, reliable power. If a transformer starts showing signs of aging, like using more energy than usual or making strange noises, it's a good idea to have a professional take a look.

Who is responsible for the transformer at an apartment complex?

This is a really common question, and the answer can sometimes be a bit tricky! For many apartment complexes, especially the smaller ones, the local utility company actually owns and maintains the transformer. They see it as part of their larger power grid.

However, for bigger, dedicated apartment buildings like The Heron, the transformer might be customer-owned equipment. This means that the apartment building or its property management team is responsible for its upkeep, any necessary repairs, and eventually replacing it. The exact point where the utility's responsibility ends and the customer's begins is usually spelled out in a "demarcation point" within the electrical service agreement. It's really important for property managers to understand these agreements. This way, they can properly plan for ongoing maintenance and future replacement needs, which definitely impacts the overall financial outlay for the apartment transformer over time.

Can a transformer be moved for a building expansion?

Yes, a transformer can certainly be moved! But it's definitely not a do-it-yourself kind of job. Relocating a transformer requires significant knowledge and skill. You'll need to involve a professional power company or highly specialized electrical contractors.

Moving a transformer is much more than just unplugging some wires. It involves strict safety rules for handling high-voltage equipment, careful planning for where it will go next, and often working closely with the local utility providers. The financial requirements involved can be significant. They include the financial requirements for specialized labor, unique equipment (like cranes!), preparing the new site, and getting all the necessary permits and inspections. If there are plans for a building expansion or renovation that might affect the transformer's spot, it's wise to factor in these financial considerations and plan well in advance. This helps ensure a smooth move and keeps the power flowing without any interruptions for our residents.

Conclusion: Ensuring Reliable Power for a Premier Living Experience

We've journeyed through the many elements that shape the financial investment for an apartment transformer, finding it's much more than just an initial purchase value. What truly matters is the complete total financial impact of ownership (TCO). This includes the initial purchase, the complexities of installation, and even the ongoing energy losses and necessary maintenance over the transformer's long life.

Every decision plays a part in this financial picture. From the transformer's kVA rating and its voltage requirements to the materials used and whether you choose a standard or custom unit, each choice impacts the overall investment. Thinking about these factors upfront helps property developers and managers make smart, informed decisions for the long haul.

Investing in top-notch electrical infrastructure, like a high-quality transformer, is an investment in the long-term comfort and reliability for residents. It's how we ensure dependable power for everyday living, for our modern amenities, and for innovative features like our adaptable Ori apartments. At The Heron Apartments by Flats®, nestled in the vibrant Edgewater neighborhood of Chicago, we are deeply committed to providing a premier living experience. That commitment begins with dependable power, ensuring our residents always have what they need, exactly when they need it.

Explore our innovative and thoughtfully designed Ori Apartments to see how modern living spaces are powered.